The insurance industry is constantly evolving, and independent agents face unique challenges in a hard market. As personal lines become increasingly difficult to place, it’s crucial for independent agents to leverage technology platforms such as quoting and lead generation tools to not only survive but thrive in this challenging landscape. In this blog post, we’ll explore the strategies independent agents can consider when reviewing their personal and commercial lines portfolio and how they can leverage leads to discover new opportunities in the personal lines market.

Embracing Technology Platforms

Technology platforms have revolutionized the insurance industry, empowering independent agents with tools and resources to streamline their operations and increase their efficiency. If you write commercial lines or want to expand those lines, commercial lines quoting and comparative rating tools allow agents to quickly generate accurate quotes for their clients, enhancing the overall customer experience. By automating the quoting process, agents can save valuable time and focus on building relationships and providing personalized service to their clients.

There are many new players in the market, including QuoteWell and BondExchange, which can help generate commercial lines quotes from a variety of carriers in BOP, GL, Workers Comp, Package, Auto, Umbrella, Surety, and Trucking.

Reviewing Personal and Commercial Lines Portfolio

In a hard market, it’s crucial for independent agents to review and assess their personal and commercial lines portfolio. By analyzing their existing book of business, agents can identify areas of opportunity and areas that require adjustments. Agents should carefully evaluate the profitability of each line of business and consider whether it aligns with the current market conditions.

For personal lines that have become harder to place, agents should consider implementing stricter underwriting guidelines and risk assessment processes. It’s essential to focus on clients who have demonstrated a low-risk profile and strong loss history. Additionally, agents should explore alternative insurance carriers that specialize in high-risk markets or niche industries.

Leveraging Leads for New Opportunities

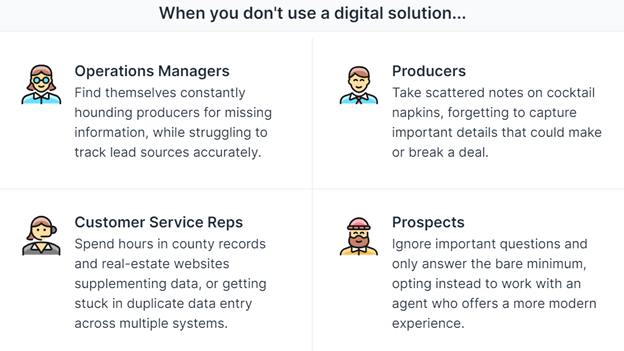

Lead generation tools can be a game-changer for independent agents in a hard market. These tools provide agents with a steady stream of potential clients, allowing them to expand their personal lines market reach. By leveraging leads, agents can identify prospects who may not have been previously within their network and develop targeted marketing campaigns to attract their attention.

When utilizing lead generation tools, it’s important for agents to focus on quality over quantity. Rather than pursuing every lead that comes their way, agents should carefully evaluate each lead’s potential and prioritize those that align with their expertise and target market. By nurturing these leads through personalized communication and tailored offerings, agents can convert them into loyal customers and boost their personal lines business.

Lead generation tools such as SALT can help you find new opportunities online with personal lines prospects. Automating the lead generation forms can make a more seamless experience to help you connect with the next right customer.

Courtesy: SALTInsure.com

Wrapping Up

In a hard market, independent agents must adapt to changing circumstances and leverage technology platforms to their advantage. Personal and commercial lines quoting and comparative rating platforms, as well as lead generation tools, offer significant benefits that enable agents to streamline their operations, review their portfolio, and discover new opportunities in the competitive personal lines market. By embracing these strategies and utilizing technology, independent agents can not only survive but thrive, even in the most challenging market conditions.