Flood insurance is one of the more difficult types of coverage to sell. Especially to those policyholders that think because they don’t live near water, they don’t need coverage. Yet, as most of us know, a flood can happen anywhere, anytime.

One of the difficulties is being able to show a property owner the likelihood of a flood at their property.

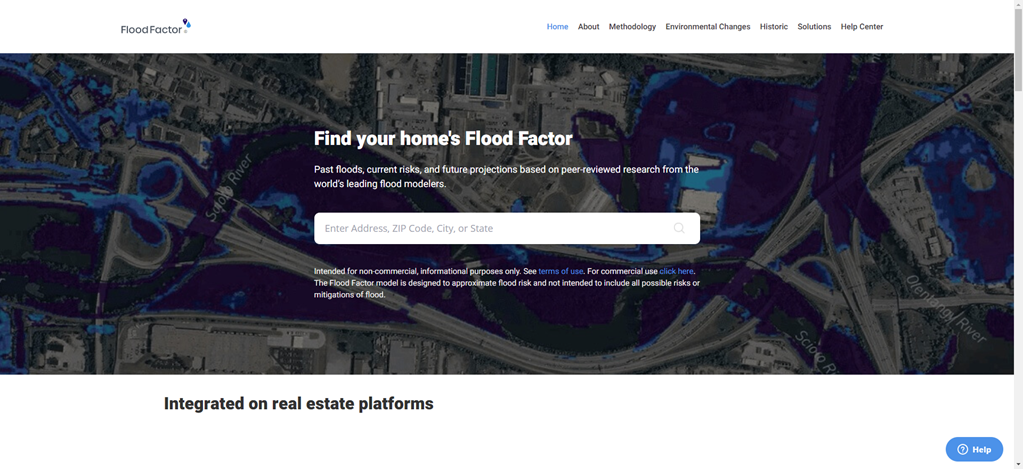

A new tool has become available to help you in this process called Flood Factor. ™

Flood Factor is a free online tool created by the nonprofit First Street Foundation to make it easy for people to find their property’s current and future risk of flooding. It also shows the flood history of the property and demonstrates how flood risks are changing because of the environment.

Flood Street worked with more than 80 scientists and researchers to remap the flood risk of every home in America. This could have a significant impact on the national housing market.

Many homes, once thought to be high and dry, have been rezoned as severe “uh-oh” areas.

What caught my attention with all of this is that Realtor.com, one of the nation’s biggest realty websites, is going to display the Flood Factor information, front, and center, on every listing.

“We’re basically building flood models that calculate the past, present, and future flood risk for every home in the country,” said Matthew Eby, founder and executive director of the First Street Foundation.

“By integrating Flood Factor into Realtor.com’s platform, we will not only reach millions of people daily, we will do so when they need it most — when they are buying or selling a home.

First Street’s mapping system sets itself apart from FEMA’s effort by including current and projected climate data. The platform also maps rainfall in real-time, which is increasing dramatically year-over-year, which is something you should probably consider when trying to predict the risk of floods.

Each property is assigned a flood score ranging from 1 (a Mojave bone castle) to 10 (Aquaman’s house).

We highlight this new platform because:

- Your office may be receiving more questions about flood insurance based on the visibility on the Realtor.com website

- It might be a good tool to use when you’re explaining why a flood insurance policy is worthwhile

- A new link to add to your website as a resource for those looking for insurance coverages

What other tools does your organization use to help people better understand the risk associated with flooding?