For agencies like Lemoyne, PA based Gunn-Mowery, LLC, the ongoing pursuit to maximize efficiency and deliver exceptional client service is essential. One area they were looking to streamline was the traditional agency bill workflow.

The Problem

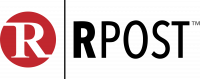

Traditional agency bill can eat up nearly half of revenue earned. This means their agents work twice as hard to achieve their bottom line. Premium finance is a great alternative, but the traditional premium finance process can further increase labor costs and purchase friction. The best course of action would be to take advantage of the benefits of premium finance AND reduce the inefficiencies at the same time.

The Solution

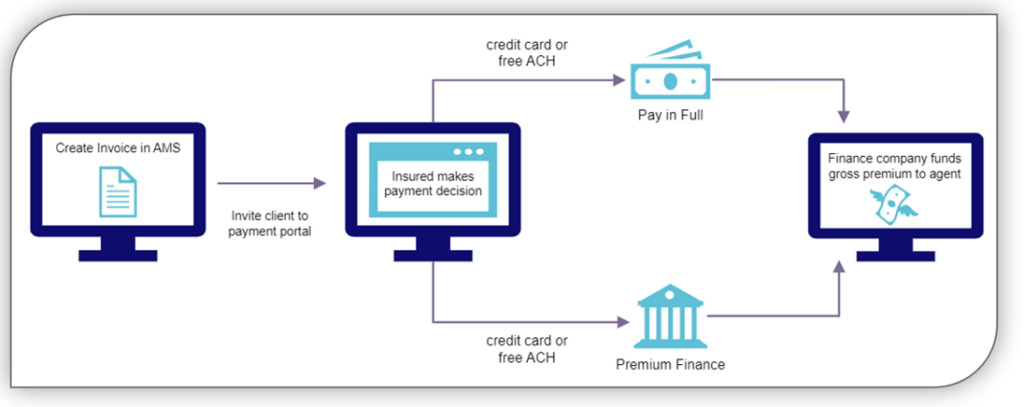

PayMyPremiums is a digital payment portal powered by AFCO Direct that simplifies the premium billing, collecting, and financing process down to a single workflow, reducing receivables by up to 80%. PayMyPremiums easily integrated with Gunn-Mowery’s agency management system allowing them to invoice directly out of AMS360® and Sagitta® – with no further steps needed. And at no additional cost. For Gunn-Mowery agents this means no more asking insureds how they want to pay, no more quoting and no more administrative hassle. For their insureds it means an intuitive, straightforward, digital experience that 1) presents a pay-in-full option alongside a financing option with competitive rates and terms, 2) simplifies the process with 2 digital payment options – credit/debit or ACH, and 3) allows for easy and immediate enrollment in recurring ACH monthly installments.

Here is the new Gunn-Mowery, LCC simplified agency bill workflow utilizing PayMyPremiums.

As their premium finance partner, all AFCO Direct needs is either already in AMS360® or easily accessible and can be entered into our software. For standard agency bill policies under $100K, AFCO Direct does not require underwriting, financial statements, or credit checks. And endorsements under $50K are as easy as an email. No forms to sign, no down payment collection.

The Results

Joe Murphy, Vice President of Finance for Gunn-Mowery, LLC, has seen the benefits for both employees and clients: “Our CSRs don’t have to create finance agreements anymore, they are so happy they don’t have to do this.”

Murphy further explains that “no fees when paying by ACH has increased the number of customers paying us electronically, and some have chosen to finance that have not in the past.” With a proven 46% take rate for premium financing when bundled with a pay-in-full option, this added revenue stream also increases their bottom line without any extra administrative effort.

Overall, Gunn-Mowery, LLC, is pleased their integration with PayMyPremiums has allowed them to maximize efficiency and deliver exceptional client service.

More about Premium Finance

Premium financing offers benefits to both the agency as well as the insured. For the agency, it solidifies you as a full-service partner by offering insureds a solution to a business risk – access to capital – and increases renewal retention through flexible payment options. Premium finance also provides your insureds with an excellent alternative to more restrictive carrier installment plans as well as an immediate payment alternative to cash. Businesses are always looking for ways to manage cash flow, even if they are strong enough to pay their insurance premiums in full. AFCO Direct can help create a cash flow analysis to show your insureds the impact of premium finance compared to borrowing company equity.

More about PayMyPremiums

Measurable outcomes from across all AFCO Direct partners includes:

- Average receivable days: 3.5

- 60% of payments made within 24 hours

- 70% enroll in ACH auto-pay

- 8 out of 5 average client satisfaction rating