From Paper Trails to AI Insights: Document Intelligence in Insurance

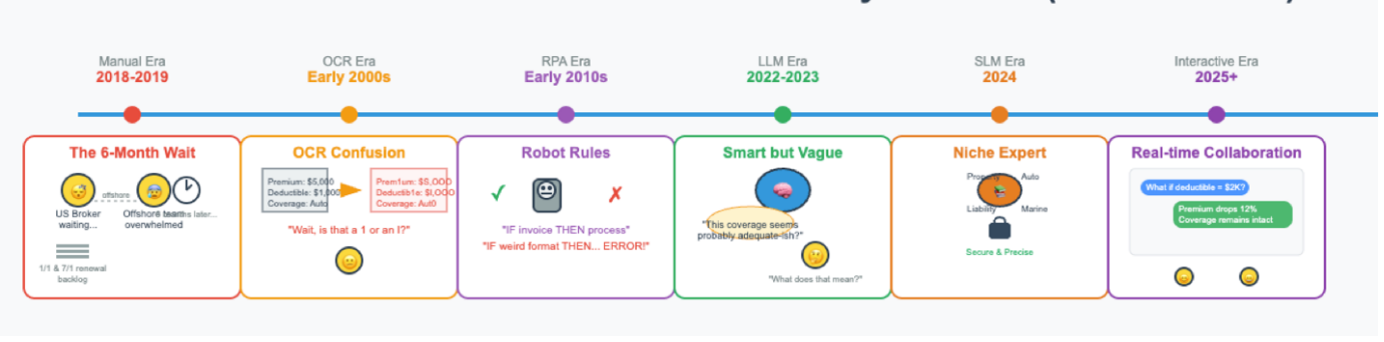

When it comes to reviewing policies for account renewals, the insurance industry has always been a document-heavy space. From applications and schedules to broker proposals and policies, the lifeblood of insurance flows through an endless stream of paperwork. As recently as 2019, it wasn't uncommon for agencies to face backlogs so severe that policies wouldn't be fully checked and processed for up to six months — leaving customers exposed to potential losses due to missed coverages. Renewal dates like 1/1 and 7/1 created perfect storms that overwhelmed both in-house teams and offshore contractors.

Technology has been quietly revolutionizing this landscape, and the journey from manual processing to AI-powered document intelligence tells a fascinating story of incremental progress and breakthrough moments.

The OCR Foundation: Teaching Machines to See Text

OCR technology represented the first breakthrough — converting scanned document images into machine-readable text. But OCR had clear limitations. Handwritten notes, faded copies, and complex layouts often confounded the technology, and while OCR could pull text from images, it couldn't interpret meaning or compare documents intelligently.

The RPA Revolution: When Robots Learned to Follow Rules

RPA emerged in the early 2010s, combining OCR's text extraction with rule-based automation. However, RPA's rigid approach struggled with insurance document variability. While it excelled with standard invoices, it faltered when faced with complex insurance documents. It could not handle the nuanced analysis insurance professionals needed.

Enter the Language Models: Promise and Peril

New LLM-based solutions like ChatGPT’s natural language understanding could read agency policies, understand coverage options, and identify gaps, but their broad training created challenges. LLMs are generalists, making their insurance-specific knowledge sometimes vague or incorrect. In insurance, precision matters — the difference between "comprehensive" and "collision" coverage isn’t semantic; it determines claim outcomes. The difference between "fire AND explosion" versus "fire OR explosion" in a property policy can mean the difference between coverage requiring both events to occur simultaneously versus coverage for either event independently.

The Small Language Model Alternative: Precision vs. Power

SLMs emerged in 2024 as a focused alternative, trained specifically on insurance documents and industry publications. This domain-specific training created a deeper understanding of insurance terminology and policy structures while providing enhanced security. SLMs excelled within their narrow domain but struggled with edge cases outside their training. They also required significant investment in specialized training data and expertise, making implementation challenging for smaller organizations.

The Vagueness Problem: When AI Confidence Meets Insurance Precision

Both LLMs and SLMs faced the "vagueness problem" — AI systems operate in probabilities while insurance professionals need definitive answers. An account manager comparing proposals needs certainty about coverage limits, not "coverage appears similar with 85% confidence." A change from "occurrence" to "claims-made" fundamentally alters coverage, but AI systems sometimes miss these critical distinctions.

The Security Imperative: Balancing Innovation with Protection

Security moved from a background concern to a foreground requirement as organizations experimented with AI document analysis. Insurance handles vast amounts of PII, financial data, and proprietary intelligence. Traditional cloud-based AI services meant trusting third parties with this sensitive information — a risk many organizations couldn't accept.

The Interactive Revolution: From Static Reports to Dynamic Conversations

Today's AI evolution focuses on interactive, real-time solutions. Instead of feeding documents into systems and waiting for reports, professionals now engage in dynamic conversations with AI. A producer can ask, "What's the impact if we reduce the deductible by $5,000?" and receive instant, context-aware answers.

Looking Forward: Hybrid Intelligence

Only a handful of systems lead the way — intelligent hybrids that leverage proprietary data models for deep, domain-specific interpretation; specialized SLMs for insurance-specific analysis; and controlled LLM integration. The destination is becoming clearer: a future where AI handles routine tasks so professionals can focus on complex analysis, where document intelligence responds as quickly as human thought.

What Is on the Horizon

Exdion is an Insurtech trailblazer that launched the industry’s first AI-based policy checking solution exclusively for agencies in 2019. We invite you to join our upcoming webinar on September 16th, hosted by Catalyit, as we give a preview of our next-generation interactive AI platform and how we are partnering with agencies of all sizes on that journey.

*As insurance organizations continue implementing AI solutions, early adoption lessons are shaping the next generation of document intelligence tools. The key is finding the right balance between innovation and the industry's fundamental need for accuracy and trust.

You May Also Like

These Related Stories

How Insurance Agents Can Use Google’s NotebookLM to Work Smarter (with Examples)

How to Actually Build SOPs

No Comments Yet

Let us know what you think