The account executive was scanning a new client file when she paused. “Something’s not right,” she thought, clicking into additional records. Within minutes, she uncovered gaps in coverage that could have left the client dangerously exposed. When asked how she spotted it so quickly, she shrugged. “After years in the business, you just know.”

That wasn’t luck. It was intuition, the highest form of expertise. While many believe it takes decades to develop, the reality is that with the right approach, you can accelerate the path from basic knowledge to instinctive mastery.

The Expertise Illusion

In most agencies, the assumption is that expertise simply comes from years of experience. But research from Anders Ericsson shows that experience alone does not create experts. An account manager could service accounts for ten years and still miss subtle risk gaps. True expertise comes from targeted, deliberate practice that builds deep pattern recognition.

What Intuition Really Is

Intuition is pattern recognition working below the surface. It is the ability to connect thousands of small cues to past experiences and act without consciously thinking through every step. In insurance, that can mean sensing a coverage gap before reading the entire policy or recognizing an unusual client request as a red flag.

The Power of Chunking

Experts do not recall isolated details. They see complete “chunks” of related information. Instead of processing coverage forms, endorsements, and client history separately, they see a full risk profile as one integrated picture. Teaching account managers to group related factors into patterns from the start accelerates their ability to see the whole picture instinctively.

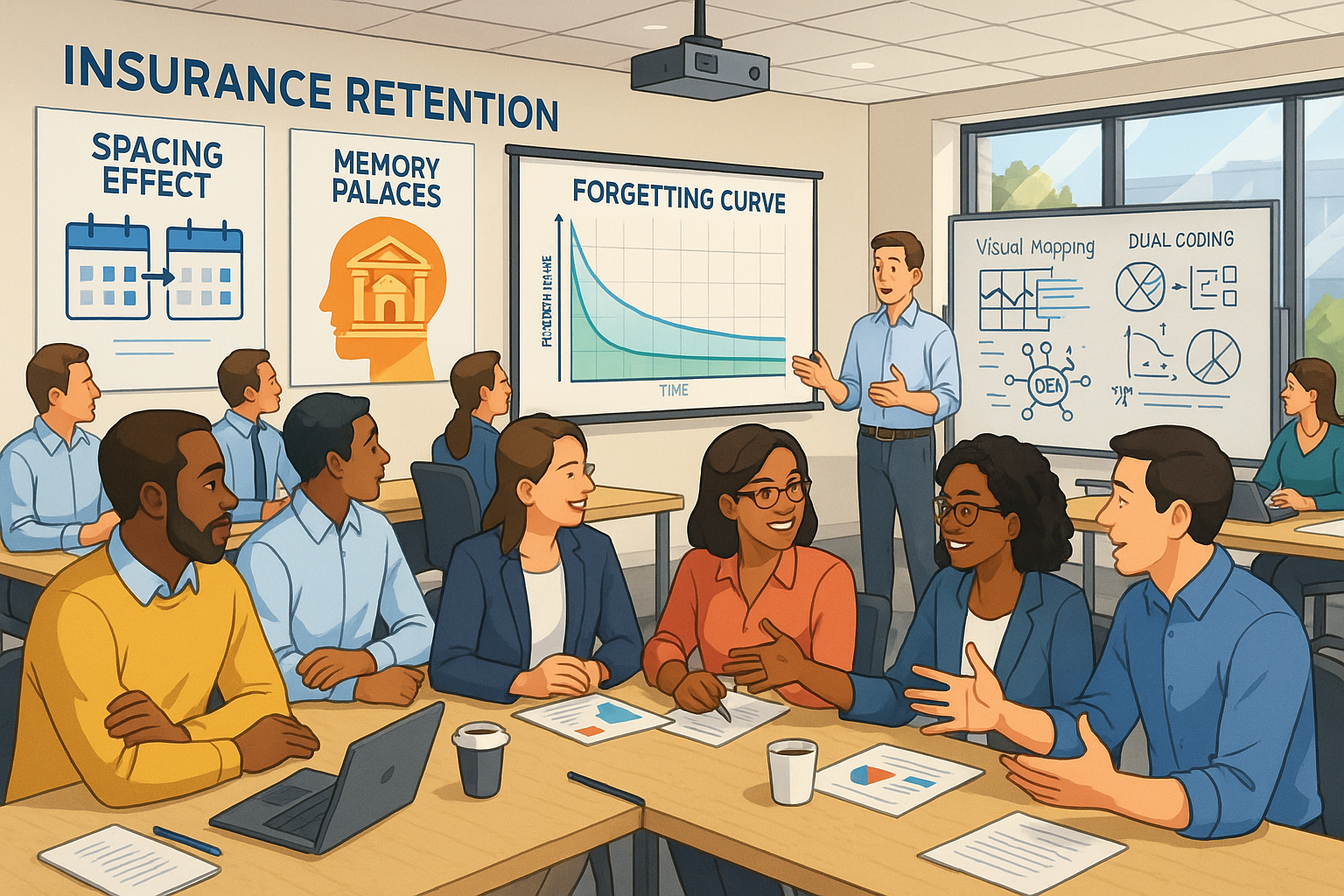

Deliberate Practice and Simulation

Doing the job is not the same as practicing for expertise. Deliberate practice means working just beyond your comfort zone with fast, clear feedback. For account managers, that might mean running through dozens of simulated renewal reviews, spotting potential E&O exposures, and immediately seeing where they were right or wrong.

Simulations are especially valuable for rare but high-impact situations such as large claims, unusual endorsements, or complex mid-term policy changes. They allow account managers to experience, learn from, and internalize scenarios they might only see once every few years.

Building Mental Models

Experts use mental models, frameworks that guide quick, accurate decisions. For account managers, that could be models for recognizing ideal coverage structures by industry, anticipating common client concerns, or identifying potential service bottlenecks before they escalate. Making these models explicit and practicing them repeatedly turns them into second nature.

Calibrating Intuition

Intuition must be tested and refined. Tracking decisions, confidence levels, and results helps account managers see where their instincts are on target and where they need improvement. Over time, this calibration sharpens accuracy and builds trust in their own judgment.

Adaptive Expertise

The best account managers adapt their intuition to new markets, risks, and client expectations. This adaptability comes from understanding the principles behind patterns, not just memorizing the patterns themselves.

The Competitive Advantage

Agencies that deliberately build intuition in their teams create a lasting edge. By investing early in pattern recognition, deliberate practice, simulations, and mental models, they produce account managers who can operate at a veteran level in a fraction of the time.

The account manager who caught those dangerous coverage gaps did not need twenty years to develop that skill. With the right training design, your team can reach the same level of instinctive expertise, and that is a competitive advantage you cannot afford to ignore.

You May Also Like

These Related Stories

Tailored Training: Why One-Size-Fits-All Fails in Insurance Education

The Future of Learning: Trends Shaping Tomorrow’s Insurance Training

No Comments Yet

Let us know what you think